Important events of arts, culture, law and entertainment and creative happening around Jamaica are listed on this site. See more by scrolling on the front page or clicking calendar in the menu above. Support Jamaica’s creative minds!

Charging on imported items is another way any country earns money. In Jamaica the customs system is based on standards set by the World Trade Organisation (WTO).

If you happen to be on the receiving end in Jamaica, whether of bought or free goods sent to you by air or sea, a good understanding of how charges come into place and are calculated before you go to collect your item, will be meaningful. Senior supervisor Miss Carol Moncrieffe, Actg. Customs Manager Parcels Post at the South Camp road headquarters of the Post Office seeks to assist Jamaicans with easing their frustrations often experienced. All duties and taxes are fixed by Policy Decisions she emphasises. These includes Import Duty, General Consumption Tax (GCT), Customs User Fee (CUF), Environmental Levy and any other tax applicable.

Before we go to the charges and calculations, here are some terms and facts you need to know.

If you are an importer, charges that will apply are:

General Consumption tax (GCT) and Duty (unless exempt from either or both)

CUF

Environmental levy

The holding area at all points of entry and warehouses, such as the post office will also charge you a daily fee. This is worked out after the allowed grace period and varies according to port of entry. One should note that storage charges is not a function of Customs unless your goods are in a Queens Warehouse which is the Governments warehouse.

Late notice and storage

This is so, even if you get a notice late or none at all – you are subjected to a daily fee from the date by documentation, that it has arrived. Bear in mind that storage and storage fees is not the portfolio of Customs. The entity responsible for holding the goods are responsible for sending the notice and charging storage such as the post office. Sometimes, this fee is dropped for reasons such as a waiver or due consideration.

Where GCT is concerned, it is applicable to most items unless deemed 0-rated, or in situations where waivers are granted, or an exemption made by policy decisions. Now where no invoice is made available, the item is subject to customs valuation.

“Duty is applied to all items where applicable, whether the item was purchased or not, whether the item is for personal usage or trade” says Moncrieffe. Whenever items are imported, the importer is required to provide an invoice to reflect the cost of the item. At the Post Office, she says “we are often told that the items are gifts. In these instances, the supplier is asked to forward an invoice through fax or email. Where no such invoice is forthcoming, then the importer is informed that the item will be subject to Customs Valuation.”

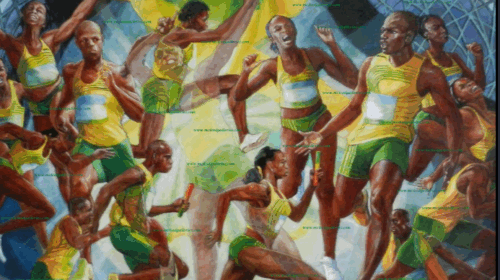

Simply put, if your item is dutiable, it will not matter if the invoice is 0.00 as duty is then charged on a value estimated by the customs officer, plus taxes listed above, unless exempted from either GCT or duty. An officer at the post office in her attempt to explain further to a client, was overheard as saying “Nothing is free, there must be some manufacturing cost to make the product, phone, fliers or so.. so just consider that the cost estimated is the manufacturing costs.” Ms Moncrieffe however did not give much explanation on how estimated value was achieved beyond ‘experience of officers’ or by institutions set up for appraising. The National Gallery is one such entity called upon to value paintings where no invoice is available..

Information on items on which duty will be applied is available to any member of the public in the customs tariff. A copy of this book can be bought at the printing office, downtown. The tariff also tells the percentage of duty that would apply to imported items.

To obtain information on the GCT – whether its applicable to your item or not, you must read the GCT act.

Calculating the costs:

(ALL duties and taxes are fixed and are policy decisions. Customs are agents of the Government who are charged with the responsibility to collect these revenues on items imported.)

The first step, according to Moncrieffe, is assessing the value by invoice, or estimation if no invoice exists. This value referred to as the CIF for convenience is based upon cost, freight, and insurance. In one particular case for example where no invoice was submitted, the unit cost of the item was assessed as if an invoice had being submitted. Therefore, based on the type of flyer and the simplicity of the graphics and size (1/3 letterhead), the minimum cost per flyer was assessed as one cent US ($.01) each as the larger the volume the lower cost. “I was able to make this assessment base on my experience as a field officer and a supervisor,” she explains.

The second step is to calculate all taxes, which may be applicable by the Post Office Customs Operations if goods are to be collected at the Post Office. In total these are import duty (20% generally), GCT (17.5% fixed by government), CUF (2% of CIF) and Environmental Levy (0.5% of CIF). Full tax charges applied reflect 43.5 % of the CIF.

Let’s have an example. On specific advertising material the total percentage is 43.50%

If the value of CIF is 100 (cost + freight or shipping + Insurance)

GCT(17.5%) is charged on the total (CIF of 100) + Duty ($100×20% =$20) so %120×17.5 = $21.00

ID ($100×20%) =$20)

CUF (100×2%) = $2.00

Environmental Levy is (100x.5%) = $0.50 cents

The cost on the value you will pay therefore is $43.50 cents or 43.5% of the CIF($100.00)

USEFUL LINKS:

http://www.cbffaj.org/notices.php

FREIGHT TERMS: http://www.yrc.com/shippers/freight-terms.html

.

Author Profile

- ... author, qualified & experienced in journalism, creative writing, editing, the arts, art critique, paralegal, photography, teaching, research, event planning, motivational speaking, workshops for children and adults, visual arts etc. Click here for contact form. ...or email me here

Latest entries

Raw and DirectFebruary 15, 2026Ways to improve Jamaica: 71-80: the law

Raw and DirectFebruary 15, 2026Ways to improve Jamaica: 71-80: the law AdvertorialFebruary 11, 2026Let’s build Jamaica, lets love Jamaica

AdvertorialFebruary 11, 2026Let’s build Jamaica, lets love Jamaica AdvertorialJanuary 30, 2026Support Jamaica Art on www.antheamcgibbon.com

AdvertorialJanuary 30, 2026Support Jamaica Art on www.antheamcgibbon.com Jamaica Art ScopeJanuary 28, 2026Hope ‘Sweetie’ Wheeler hosts dynamic art studio

Jamaica Art ScopeJanuary 28, 2026Hope ‘Sweetie’ Wheeler hosts dynamic art studio